China has suffered its worst economic collapse since the 1970s, it fell 6.8% January-March year-on-year, but the demand for buying homes still rose. Where are people finding the confidence to still buy properties in the midst of an international financial crisis?

Minglei Li, a 31-year-old engineer, watched the price of his favourite home soar by nearly one million RMB, around £111,480, in a few months after the outbreak of COVID-19. To buy a cheaper apartment, he had to participate in several rounds of a new-dwellings “lottery system”, which allocates purchase qualifications by the lots drawn. Only designated persons can be qualified to buy the limited flats in a complex.

The competition for the home-purchasing stipulation was intense. The winning rate of the home-purchasing qualification was only 0.5% in the second round in which he participated, which meant that only 5 out of 1,000 people could buy their homes in this particular round.

To cope with the risk that he might be unable to qualify, MingLei said: “So I have two strings attached to my bow – keeping an eye on old and new dwellings simultaneously.”

You can’t solve the problem of residence without owning your own home, and this home is also tied to the school your kid will attend

Minglei Li

Minglei doesn’t expect housing prices to rise rapidly once COVID-19 in China subsides. In April, the overall home prices in China’s 70 cities had risen, according to the National Bureau of Statistics. The property market in Shenzhen, one of the first-tier cities, was the most attention grabbing among them all. The prices of its old dwellings led the country with a 1.6% increase.

Dajie Tang, director of the Research Department at the Saiyi Enterprise Research Institute, believes that the reasons for the possible increase in housing prices after the pandemic will vary greatly. “Firstly, other investment ventures are too risky, and real estate will still be the first choice for investors. Secondly, the central bank will release liquidity, and a large proportion of it will flow into the property market, Thirdly, international investment will flood the country”, said Tang.

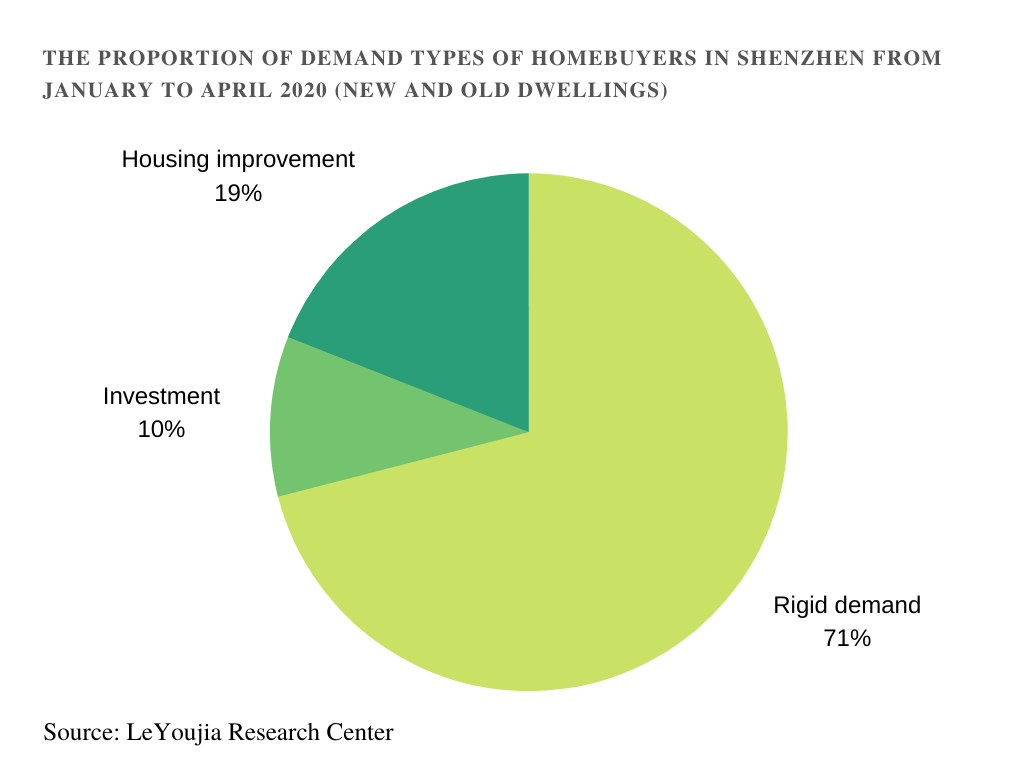

The increase in Shenzhen’s housing prices has a lot to do with the strong demand for homes by millennials. According to a report from the Leyoujia Research Center, the primary goal of 71 per cent of the properties sold from January to April was geared toward self-occupation. Among them, millennials are the main buyers of Shenzhen’s properties, with 56.4 per cent of them being post-80s and 27.7 per cent representing post-90s.

Part of the demand was driven by millennials like Minglei Li, who was planning to get married. “You can’t solve the problem of residence without owning your own home, and this home is also tied to the school your kid will attend”, said Minglei Li.

Buying a home not only provides a roof over these millennials’ heads in the city, but is also closely connected to their rights in the city, such as children’s schooling issues. According to China’s “Nearby School” policy, the public schools that children will attend is based on their place of residence. Usually, every public school is associated with a catchment area. If a child’s home is located in one of these locales, he/she is then allowed to enrol in that particular school.

This circumstance results in the fact that the quality of the school near their potential residence becomes one of the main considerations for home buyers, excluding factors such as housing prices and transportation.

Real estate is the key to a family’s future wealth;

it is a form of security

Dr Arianne Gaetano

Working in the IT industry, Minglei Li prefers to buy a home in Nanshan District, which has been dubbed China’s Silicon Valley, where well-known technology giants such as Tencent, ZTE, and Da Jiang Innovations converge. This place is not only convenient for him job-wise, but also has excellent educational resources.

Nevertheless, the housing prices in this area are not cheap. The average house price, 111,558 yuan/㎡, around£12,271/㎡, ranks number one amongst Shenzhen’s other districts. The mortgage fee for Minglei Li’s new home could account for 60%-70% of his family income, which crosses the warning line of the bank.

It becomes a more practical concern to buy a home, especially with the expensive housing market. “Real estate is the key to a family’s future wealth; it is a form of security”, claims Dr Arianne Gaetano, Associate Professor of Anthropology at Auburn University.

Shenzhen was once a small fishing village. It was selected as a special economic zone during China’s reform and opening up in the 1980s, and became a window for China to communicate with the rest of the world. Since then, national policies plus its advantages as a port, have turned this tiny town into a shining city in China.

Within 40 years, the population of Shenzhen has increased about 42 fold, based on the Shenzhen Statistical Yearbook 2019. Population growth has produced a high demand for housing, but according to a study by Jing Liu, Shenzhen’s newly-added land supply in the past ten years is extremely small, while the population is continuously growing. When supply becomes less than demand, Shenzhen’s housing prices will, without question, continue to rise.

Faced with the skyrocketing housing prices, Minglei Li felt that buying property represented a wise investment. Although he has already bought some stocks and bonds, he still believes that buying properties is the optimal way to invest.

However, purchasing properties may not be the best choice when considering investments since it also depends on a country’s real estate policies. “Investment depends heavily on the perfection of our country’s real estate market system. Assuming that the real estate tax is implemented, buying a house is not necessarily the greatest way to maintain value, and portfolio investment is a better choice”, said Dong Zhang, Professor of Zhongnan University of Economics and Law, School of Finance.

Credit:Tonyttan on Weibo

Credit: Clouds on Weibo

Credit: Clouds on Weibo

Shenzhen property’s boom once fuelled MingLei Li’s fear of the bubble burst and reminded him of Japan’s bubble crisis in the 1980s, when everyone’s desire for real estate was spreading like wildfire in the country.

“It feels like no one can be sure of anything, it’s similar to gambling. But I think the regulatory capabilities of China’s government is stronger than that of Japan. China’s development relies strongly on realty and our economy is driven by real estate. So I think it won’t go bust”, said Minglei Li.

One shall have peace of mind when he possesses a piece of land, a property is the motivation for the personal struggle of home buyers

Professor Qing Xu

Minglei Li’s judgment is valid. Under the Chinese constitution, all land in China belongs to the state. In the 1994 tax-sharing reform, China’s local government found that once real estate investment was soaring and real estate prices remained high, they could obtain fiscal gains, which pushed the local government to set out on the road of “land finance”.

The main principle of “land finance” is to offer public services and infrastructure through the sale of value-added land for the next seventy years. China’s local governments rely deeply on land sale revenues and use future land sale profits as collateral to raise debt.

Qing Xu, an assistant professor at Beijing Normal University, School of Government, believed that during the economic downturn, those who had bought properties may have enjoyed more financial support than those who did not, under the these two parties’ matching circumstances.

“One shall have peace of mind when he possesses a piece of land, a property is the motivation for the personal struggle of home buyers”, Qing Xu stated.