With young people increasingly priced out of both renting and buying a house in the UK, how are they trying to get on the property ladder?

It was the date near the end of his master course and his tenancy of his apartment in Cardiff. Ruan Hallet, a twenty-two years old student at Cardiff University, holds his phone and scratched his scalp while texted to his parents and discussed the place he can live in when back home.

Ruan has a brother who lives at home, but there aren’t enough room at his parents’ house for both brothers to live in. One of them has to sleep on the sofa in the living room, when they are both at home. But sleeping in the living room hardly can have any private space, said Ruan.

“I will probably live in a caravan until Christmas before I get a job and rent a place.”

“Hopefully, I will get a job that pays me 20,000 pounds a year but probably it will end up lower than that like 19K, the house price at now is too high for me to buy. Even though I decide to buy a house later on, I need to rent my own place to live. The total salary minus the rent, food, and other living costs, it will take me decades to afford a proper house by myself under the current prices.”

“I will work in my brother’s baker shop as a full-time baker shortly after I get home,” said Teddy Moses, who lives in the northwest of London and his parent’s house has sufficient spaces for two brothers.

“My brother will pay me 11.50 pounds hourly which means 18,000 pounds a year. I will live in my parent’s house and my brother’s shop is near the house so that I barely have any living cost and can save the majority of my wage.”

“I only need to save a year salary that I can afford the deposit, no mention that my parent will defiantly support me financially,” said Teddy.

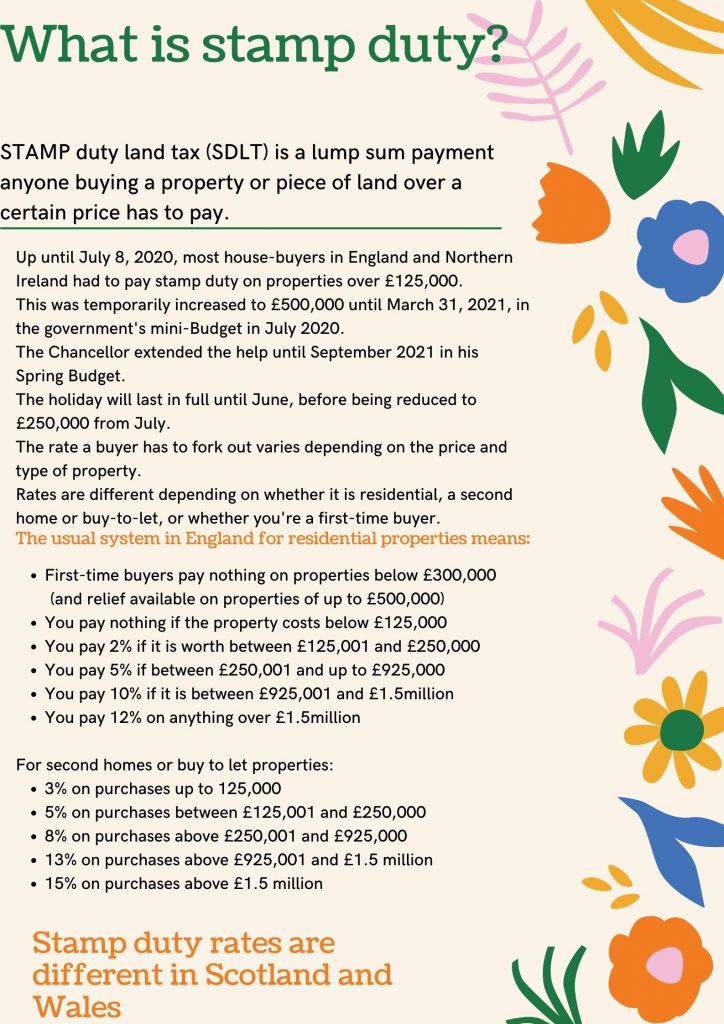

The house prices in the UK are currently at their moment of glory, which has reached a record high in nearly seven years in May, the trend is still going up thanks to the extension of the stamp duty land tax holiday and increasing demand by richer household, the Bank of England’s chief economist said on Tuesday.

Data released by the Nationwide building society indicated that the UK house prices surged 10.9 percent due to the increasing demand for property in the year to May, the highest level in seven years.

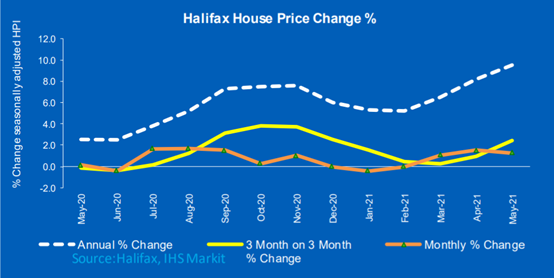

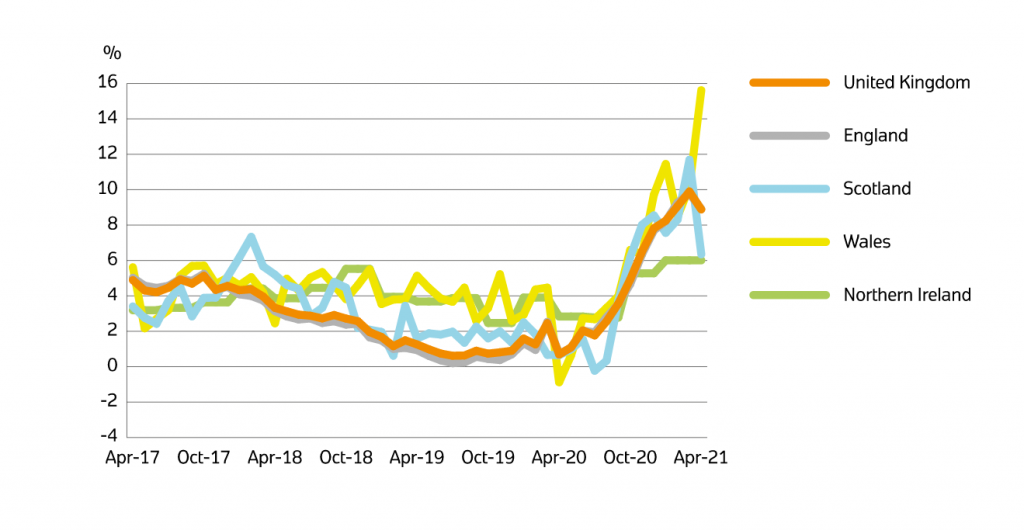

The average house price, which is indicated by Halifax’s monthly house price, has risen to £261,743, an increase of 9.5% over the past 12 months. Year-on-year house price rises accelerated in all regions of the UK except the North-East during last month. The strongest growth was again in Wales (up 11.9 percent last year), followed by the North West and Yorkshire & Humber, which both saw double-digit annual growth.

The latest RICS Residential Markey Survey shows that the demand across the UK house market remaining high whereas the new instructions supply lost impetus. New buyer inquiries present an upward trend which increased to a net balance of +44%, up from +43% in March. But new instructions fell to -4%, down from +21% previous period. The house stock level has dropped significantly in recent months, the average number of properties registered by real estate agents is now 40.

“The tax holiday (stamp duty) is one of the major motivations of the price growth during last 6 months, which makes the house purchase relatively more attractive, the deadline of tax holiday in Wales ends at 30th of June. This policy throws a lot of demands forward, people want to take that advantage,” said Dr. Kevin Evans, a reader in finance at Cardiff Business School of Cardiff University, who specializes in the empirical asset.

“These trends, coupled with growing confidence in a more rapid recovery in economic activity if restrictions continue to be eased, are likely to support house prices for some time to come, particularly given the continued shortage of properties for sale,” said Russell Galley in the report, Managing Director of Halifax.

Andy Haldane, Bank of England chief economist, alert that this trend of rising was very likely to exacerbate inequality and blame the rising price on the insufficient house supply.

Andy believes that if the policymakers don’t settle the problems in the supply of homes, we will “inevitably see a sustained rise in house prices relative to incomes, as we have seen over the past 30 to 40 years,” said Haldane at a virtual conference on inequality organized by the University of Glasgow.

“The higher the prices go, then the less affordable it becomes for the very lowest income earners. It’s like a vicious circle, those who’ve already owned a house see their house value continually goes up and they will be wealthier, whereas, for those unlucky people who are not yet property owners, they will find it more difficult to buy,” said Dr. Kevin.

“However, the rising house prices are unlikely caused by the shortage of the supply. Because if that is the case we will see the cost of the rental property going to the roof, which we are not seeing happen. The supply thing is more like for low-income earners to see.”

As the house price hitting a record high at the moment, the current affordability across the UK property market is at its worst in a decade. According to research released by estate agents Benham and Reeves, the average house price to income ratio at its highest since 2011.

Despite strong salary growth in 2020 which result in the average net salary achieving £25,123 in 2020, the latest average house price of £25,000 places UK house price to income affordability at 9.95, which means that the house prices are currently ten times the average salary and the average down payment requires at least a year’s salary.

The current house price to income ratio is the highest since 2011, it increased to 9.95 from 8.16 in 2011 and that’s above the recent high of 9.80 set in 2017.

“Since the middle of 2020, the rise of wage and the inflation level remains low and steady right up until two months ago, people have more extra money to spend. Combined with the fact that the interest rate is incredibly low at the moment, the mortgage is likely more affordable,” said Dr. Kevin

“While house prices are still below their previous peaks, this new national high suggests that the huge financial costs of climbing the property ladder in the UK have grown even more for those trying to get their foot in the door,” commented Marc von Grundherr in the research, director of Benham and Reeves

“Unfortunately, even with stronger wage growth in recent years, incomes have failed to keep pace with house prices, so we are likely to see affordability problems get bigger before house prices start to fall.”

Although the spikes in the prices of the houses, the growth in private rental prices paid by UK tenants was essentially flat between November 2019 and the end of 2020. Rental growth slowed at the start of 2021, driven by London prices, according to ONS.

Larger properties have seen the fastest rise in rents, a trend that has been underway since the market reopened last summer after the first lockdown. Since then, tenants have prioritized outdoor space and work-from-home rooms.

The average rent for a four-bedroom flat rose to £1,805 a month in May, up 9.5 percent on the same month last year. Rents for one-bedroom homes, meanwhile, held relatively steady, rising 0.4 percent.

According to the estate agency Hamptons, with the surging house prices, it is now cheaper to rent a home than buying. On average, first-time buyers with a 10 percent deposit spent £1,125 on their mortgage repayments last month but were likely to pay £71 less with the average monthly rent of £1,054

“For first-time buyers in particular this pushed up the cost of paying a mortgage if they could get one at all, to well above the cost of renting,” said Aneisha Beveridge of Hamptons in their report.