Never thought about your pension? It’s the perfect time to start planning ahead and imagine your ideal retirement lifestyle, say experts

Retirement isn’t something we worry about at 19 and have student debt, or when we’re 25 and receiving entry level pay-checks. What about when we’re 29 and trying to scrape some funds for a mortgage?

The 2016 cuts in UK interest rates to a new low of 0.25% is concerning to us all. Add that to this year’s 7.7% increase in housing prices and the near future looks unpromising, let alone our OAP futures.

Scottish Widow’s 2016 Retirement Report shows that 29-32 is the age current 18-21 years olds think we should start saving for a pension, while 31% of us believe our retirement lifestyle can be funded by inheritance.

But investment groups are encouraging the British government to ensure we start thinking about pensions soon, and to observe our current financial situations with eyes to saving for retirement.

While the governments attempt to do so seems successful in figures with 56% currently saving, 40% are only doing so because of workplace auto-enrollment. The self-employed are therefore left somewhat in the red.

Here’s what Cardiff’s self-employed have to say about pensions:

Self-employed business owner Philip Starybrat, 28, said that as he’s saving up his money to his best ability for future assets such as a property, he doesn’t see himself starting a pension fund anytime soon.

“It’s easier for someone who’s working for a company as the employer decides the best scheme,” he said.

Philip moved from Poland to Wales for his undergraduate studies in drama, and admits that the British Government has more financially effective strategies than Poland, such as tax and public pension schemes.

Philip moved from Poland to Wales for his undergraduate studies in drama, and admits that the British Government has more financially effective strategies than Poland, such as tax and public pension schemes.The 2016 nationwide average of an individual’s pension fund is £307,000. But the Scottish Widows Report says that 22-29 year olds think £351,000 is a realistic fund. Perhaps financial misperceptions are putting us off saving for retirement when in fact we could be helping retired selves.

What does it mean for me?

As state pension ages increases from 60 for women and 65 for men to 66 for both genders by 2020, Experts This Is Money urge us to save a pension as early as possible.

This age is predicted to rise to 67 by 2028, and reflective of life expectancy in the years following. In short, we’re likely to be working until we’re 70 if we carry on saving as we do.

With advancements in medicine and health choices, financial experts Admiral estimate life expectancy will be on average 86.7 by 2030. With expected longer retirements, the Welsh insurance company emphasise our need to begin thinking smartly.

They said, “Starting at age 25 and investing £5,000 per year in an investment that grows 6% a year would leave you with over £400,000 more by the age of 65 than if you started saving at 35.”

“Freelancers will be working to the death.”

But most self-employed earners said that saving at 25 for a pension is unrealistic. An alt.cardiff survey this month revealed that only 66% of us are currently saving for a pension, and most of us admitted to putting it off until our late thirties.

Freelance Photographer Rob Matthews, 26, from Cardiff, is a prime representative of an unconfident generation. “Young freelancers at the moment will be working to the death,” he half-joked. “I haven’t started planning,” he said, adding, “and to be honest this is the first time probably since starting out that I’ve thought about it.”

Rob has been self-employed for three years and while Cardiff is a vibrant city for his photography, “the location doesn’t matter as I’m hopeless at saving,” he said.

Rob has been self-employed for three years and while Cardiff is a vibrant city for his photography, “the location doesn’t matter as I’m hopeless at saving,” he said.What can I do?

Financial experts Clear Money said that the best way for us to save is through a low-risk personal pension. This enables investment through simple saving, stocks, shares, bonds and property into a regularly contributed pension fund. This includes alternative benefits to company pension schemes such as a pension payable to your spouse.

We may also find their ‘low-risk’ strategy useful for alternative saving, like mortgages or paying off debts, as it encourages investing low amounts to begin with. This will increase closer to retirement age as short-term changes in the stock market won’t affect the amount too much by then.

“It might be tough in your mid 20’s to commit to £300 per month to a pension fund, especially if it’s a significant portion of your salary,” said retirement company Fix My Pension. They added, “but £300 per month may not be such a big deal a few years down the road.”

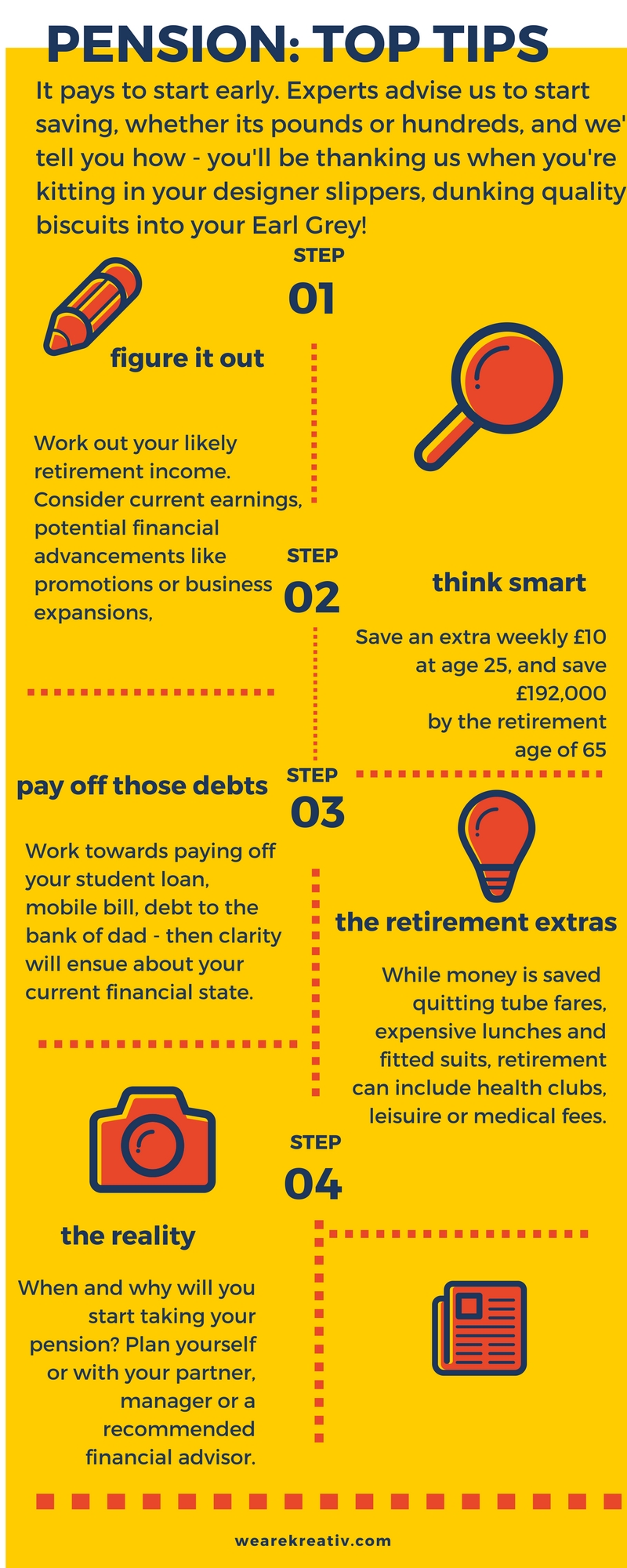

They also encourage a “roughing out” strategy, using simple spread sheets to gage when any loans will be repaid and imagining your retirement lifestyle.

Admiral, however, also warned the 40% of Wales who believe investment companies’ statements that cash is a “safe-haven” in volatile times, as current and expected ultra-low interest rates will reduce money in bank accounts to an almost “non-existent” return. Admiral remind us that saving in cash will actually reduce our pensions funds as the interest gained in ISA’s and other savings accounts is completely non-existent.

“A home is an asset you can make liquid again.”

And for those wishing to save simultaneously for a pension and mortgage, Dean Marfin of financial planning service Key Recruitment said younger generations can rely on property as a retirement asset as rent payments mean less funding for pension pots.

Following the 16% decrease in young homeowners since 2011, Marfin reminds us that, “the home has value and it’s not too bad to rely on it – your house may well be your pension.”

Learn how Cardiff became a Living Wage city.