Making sense of the cryptocurrency world – highs, bank bans and caveats to consider if you plan to invest

Business Magnate Elon Musk added ‘Bitcoin’ to his Twitter profile recently and within minutes 15% growth was seen in its value, going over £25,500!

Cryptocurrency investors have seen record highs even before this move, but some UK banks have refused to process payments or accept transfers emerging from this digital currency with no physical existence and no government control.

This has been a cause of worry for those were planning to buy some. However, experts claim there is not much to be worried but provide caveats to buyers.

A Penarth-based cryptocurrency investor and one of the organizers of the 635-member group Bitcoin Wales (BW) says, “The banks need Bitcoin more than the Bitcoiners need banks. There will always be another bank willing to accept your custom.”

He said, “Random things like this pop-up and then disappear. Essentially, it makes no difference. Fear is most often sown when the price of Bitcoin rises by those with vested interests in ‘trying’ to slow Bitcoin adoption down.”

A number of Wall Street banks like JP Morgan have predicted growth in popularity of cryptocurrency. In 2019, it came up with its digital coin representing Fiat currency using blockchain technology and launched it in 2020.

However, UK’s financial watchdog Financial Conduct Authority has issued a warning to retail (individual) investors regarding risks involved and has asked people to beware of schemes that might promise massive payouts. Crypto-investors are not protected by schemes that help reclaim cash when businesses crash.

Bitcoin Wales organiser said, “Bitcoin is the alternative (to Fiat currency), as no one person or government controls it. We know how much will be created and it can’t be changed. So, anyone benefiting from the existing financial system has vested interest to slow adoption.”

Fiat money is government-issued currency that is used in everyday life via bills and coins, and now digital payments. These have a physical existence somewhere on the planet, unlike cryptocurrency. Fiat currency is regulated by the central bank of a country.

The BW organiser’s view has been partly echoed by JP Morgan strategist, David Lebovitz on JP Morgan Solutions blog, “Part of what has made cryptocurrency so attractive in recent years has been this lack of centralisation and oversight. Individuals continue to embrace cryptocurrencies due to a fear that reckless government spending and elevated levels of debt will render fiat currencies worthless.”

This is further explained by BW organiser as – “No one person or government controls Bitcoin (cryptocurrency). We know how much will be created and it can’t be changed. Fiat currency is created out of thin air and pumped into the system by central banks and is influenced by politicians.”

He said that currencies are controlled and printed at will on a country-by-country basis, generally de-valuing them. That means that each year you will end up buying less and less with the same amount of money. That is why £100 buys you less today than it did 10 years ago.

Explaining who should invest and how not to view this investment, David Lebovitz said, “For investors who are comfortable taking on a bit more risk, an investment in cryptocurrency might be appropriate. That said, for those who view it as a panacea in a world of uncertainty and historically low interest rates, a bit of caution may be warranted.”

Adding on, the BW organiser explains how to go forward with buying cryptocurrency: “Invest some time learning about cryptocurrency and do your own research. Don’t just trust, verify. Don’t purchase bitcoin with credit and never invest more than you can afford to lose. Use a reputable exchange that allows you to withdraw your bitcoin into your wallet and do so after you’ve learnt how to do that securely”

“I have learnt to use Bitcoin as a long-term savings tool by saving little and often,” he said, “but, there is no real shortcut.

In its 2021 predictions, JPM projects a positive future for cryptocurrency: “With central banks so committed to reaching and then overshooting their inflation targets, there is no realistic end to ‘paper’ money printing for the foreseeable future. It will continue to drive asset price inflation and encourage investors to look at alternate stores of value. While critics point out that bitcoin lacks many of the safeguards present in traditional currencies (enforceable exchange via rule of law, etc…), for current users that may be one of its most attractive characteristics.”

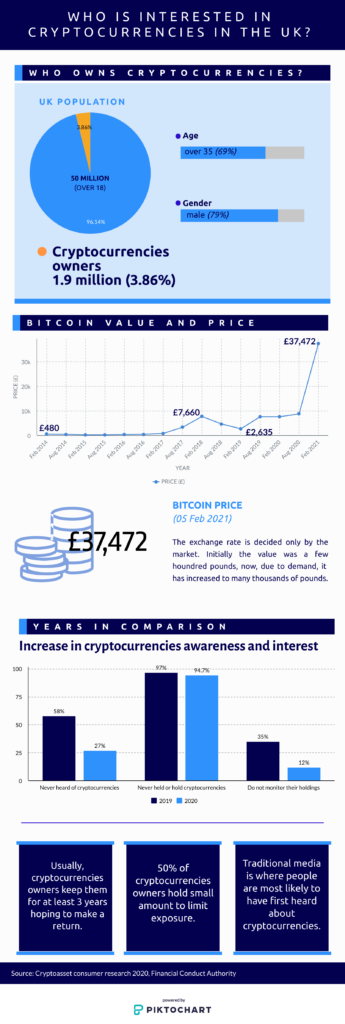

Hundreds of other small and large businesses accept cryptocurrency. About 28.5 million individuals across the world own a minimum of 0.001 BTC as per data provided by Bitinfocharts. In the UK, an estimated 1.9 million people hold cryptocurrency, notes FCA.