As Cardiff proposed tourism tax, local hotel owners are raising concerns about potential effects. What lessons can Cardiff learn from other cities to avoid negative impacts?

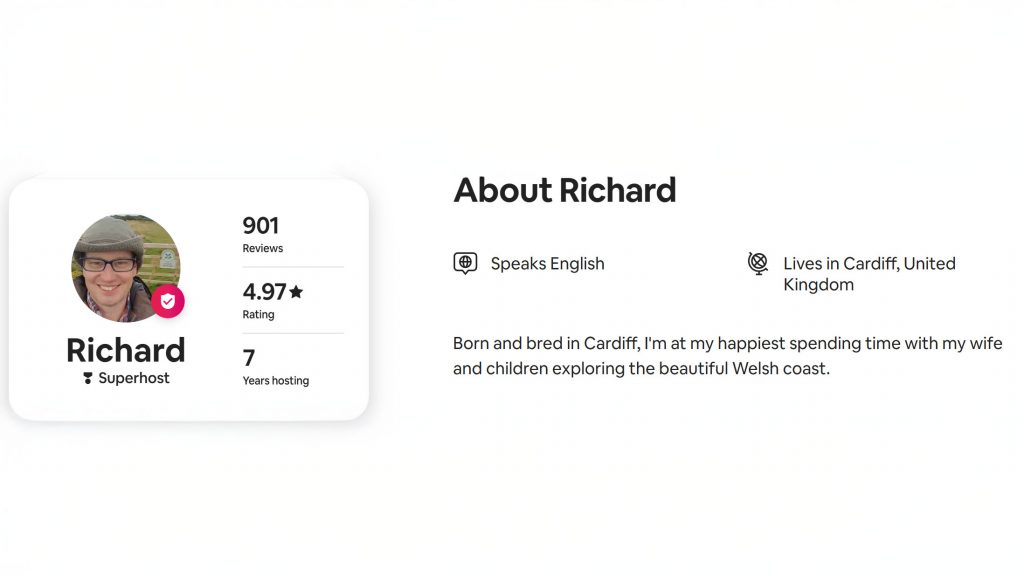

It’s another busy morning at an Airbnb hotel near Cathays.The hotel owner Richard wakes up early to check his latest reservation and pricing against competitors. Every pound matter in this business, and even the smallest increase can push potential guests to look elsewhere. Now, with Cardiff’s proposed £1.25 tax, things are about to get even tougher.

Yes, it’s a small fee, but it’s huge to the hotel owners in Cardiff. It is the tourism tax recently proposed by the leader of Cardiff City Council to raise funds for the city’s infrastructure, events planning and public services that support visitors and residents. Guests will have to pay an extra £1.25 per night in hotels, B&Bs and self-catering accommodation, and an extra 75p in hostels and campsites.

“The tourist tax puts people like me, trying to earn supplemental income on Airbnb, at a disadvantage. I check prices daily, and every extra pound push guests away. This tax will make it harder for me to compete and will worsen the accommodation shortage, hurting local businesses. The only winner is Bristol and the South East of England,” said Richard. “My fear is that the money will simply disappear into the Senedd’s general funds, rather than directly benefiting Cardiff.”

Holly Davidson, head of recruitment at the Welsh Parliament, said: “I don’t think it will make Cardiff any less attractive to visitors, Cardiff is very good at attracting big concerts and rugby matches. If people pay their taxes to have a better experience here, it’s worth it. I’ve paid tourist tax on overnight stays in France and I still have a great time.”

Welsh government Finance Secretary Mark Drakeford said: “We believe it is fair visitors contribute towards local facilities, helping to fund infrastructure and services integral to their experience.” If the Visitor Accommodation Bill is passed by the Senedd, it will decide whether to charge fees. It is expected to start from 2027 and will also apply to children’s accommodation. Councillor Huw Thomas said £4 million would be raised for the council based on visitor numbers in 2019.

Tourism taxes are nothing new in Europe, with cities such as Paris, Amsterdam utilizing them to fund infrastructure and protect cultural sites. Manchester became the first UK city to introduce a tourist tax in April 2023, charging £1 per room per night. According to the Manchester Accommodation Business Improvement District the tax generated approximately £2.8 million in its first year, which was reinvested into marketing, cleaning and activities designed to improve the visitor experience. Manchester spokesman Kumar Mishra said the charge had a positive impact on the local accommodation industry.

And Cardiff can learn a lot, according to Dr Ghufran Ahmad, of Cardiff University Business School,believes that the council’s proposed estimate of £4 million of expected revenue based on 2019 visitor numbers may be overly optimistic. He explained that the tourism market in Manchester is much larger and that its estimated revenue in the first year after implementing the tourism tax in April 2023 was around £2.8 million. “Manchester has been in the top 3 towns for staying visits from 2003-2022 with an average of almost 1 million staying visits. During the same period, Cardiff has been in the top 15, except for 2021 when it was seventeenth, with an average of 0.3 million staying visits,” said Dr Ahmad.

Regarding its impact, Dr. Ahmad said: “The tax itself is unlikely to be particularly disruptive, given its relatively low amount, especially if it is used to enhance the experience for tourists. However, this tax should be viewed in conjunction with other changes that would affect accommodation providers like the changes in holiday let tax.”

To ensure that the tax is used effectively, Dr. Ahmad emphasized the importance of feedback from visitors. “Surveys can help identify aspects where improvements can be made,” he suggested.

Ultimately, on how Cardiff can minimize potential drawbacks, Dr Ahmad highlighted the importance of distinguishing the differences between the Manchester and Cardiff tourism markets. “When imposing taxes, the general idea is to ensure that the demand is relatively inelastic so the number of tourists is not too affected after the implementation of the tax. In this regard, a comparison with Manchester would help determine whether any important differences across the two markets can lead to significant distortions after implementing the tourism tax in Cardiff,” he said.

Furthermore, he stressed the necessity of involving key stakeholders in discussions to address Cardiff’s specific challenges. “Engaging with local businesses and accommodation providers is crucial to understanding how this tax will interact with existing regulations, such as changes in holiday let tax, which could alter its overall impact on the tourism industry in Cardiff.”