The cost of living in the UK has been rising, adding financial pressure on students. Is the UK still an affordable place for international students?

At 3 a.m., Manasi Gaikwad, an Indian master’s student at Cardiff University, is still glued to her laptop, working hard to finish her assignment. Even though she is tired and her eyes are heavy, she knows she has to keep going. In just two hours, she has to get up early again, rush to catch a bus at 6 a.m., and travel to the outskirts of Cardiff for her part-time job.

There are only two things she can do if she misses that bus. She can either wait another 25 minutes in the cold morning air or pay £15 for an Uber, which is almost what she makes an hour.

“My parents have already sacrificed so much for my education. I don’t want to ask them for more, so I have to figure things out myself,” she says. “But when you spend all your time working and worrying about money, you feel like you are not actually living. You are just surviving.”

Manasi got her part-time job in November of last year, a few months after moving to the UK. On her first paycheck, she got only £600. By the end of the month, she had only £50 left. She says it was hard for her to stick to her budget at first because she had to buy so many things, from winter clothes to food, and other necessities.

“Many students are missing university and focusing only on their part-time jobs because, for them, survival has become more important than studying,” says Manasi.

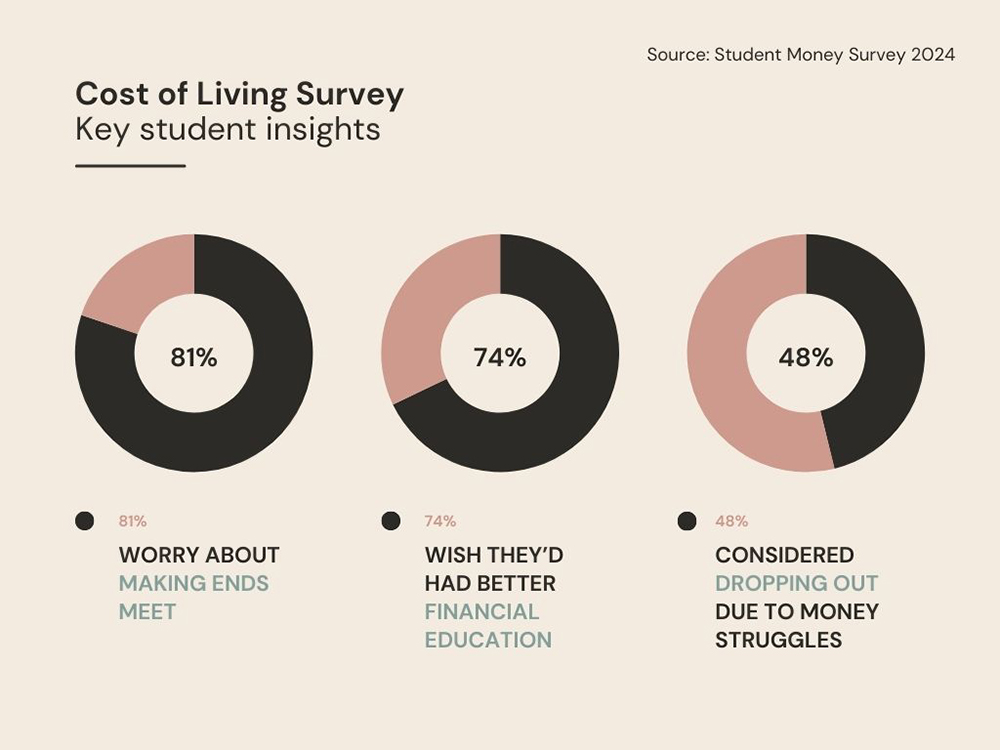

Manasi’s story is typical of many UK students who are having to deal with rising living costs. For example, 52% of students run out of money before the end of term, according to the 2024 Student Living Index by NatWest. The financial strain is growing, and students across the UK are struggling to keep up.

Additionally, a survey carried out by Red Brick Research showed that 72% of students have been forced to make sacrifices in response to the cost-of-living crisis, with nearly one in ten students experiencing such hardship that they may be unable to continue their studies.

While Manasi is struggling as a student, graduates are not faring much better.

A post graduate student from Cardiff Metropolitan University, who pursued his degree in Accounting and Finance, has been working full-time at a local dessert shop in Cardiff since completing his degree last year. Despite holding a postgraduate qualification, he has been unable to find a job in his field.

Aryan (not his real name) requested to keep his name anonymous since he is still in hope for a great career job in the coming future, which he does not want to risk in any way possible. Having said that, he further talked about how difficult it is to find your own place in the industry you want to be in.

“Every accounting and finance job I apply for asks for UK work experience, which I don’t have,” he says. “Even for entry-level roles, they want candidates with at least six months of local experience. I tried offering to work as an unpaid intern just to gain experience, but I was still turned down.”

“It’s been a few months since I started working full-time, doing 40 hours a week, earning around £11.50 per hour. Even though I earn around £1600 per month, yet I still struggle to make ends meet. After paying £700 for rent and covering transportation and food costs, I don’t even have the bare minimum left for myself,” says Aryan.

As prices keep rising, he has noticed the impact on his daily expenses. “Groceries have increased drastically,” says Aryan. “Initially, we compared prices at different supermarkets, but after the minimum wage went up, we saw that many grocery prices also increased. Even transportation costs are higher. The Cardiff Bus annual pass used to be £200, and now it’s £300 or £350.”

“Rent is obviously very high here. Also, I have other commitments. I must send some money home every month because I have multiple loans. I placed my gold as a loan for my education, so I need to pay the interest. On top of that, I also have my student loan,” says Aryan.

For him, the struggle is not just about covering basic expenses. There is also the uncertainty of his future. His post-study work visa gives him two years to find a job in his field, but he worries that without UK work experience, his chances will continue to shrink.

“If I return home after two years without experience in my field, employers will question what I have been doing all this time,” says Aryan. “At that point, my degree will be meaningless. I might have to start a business of my own, but even that requires money.”

As living costs continue to rise, studying abroad is becoming less about education and more about survival. Many students are prioritizing financial stability over academics, while graduates take full-time jobs only to find their salaries barely cover essential expenses.

“My parents have paid my entire tuition without taking any loans, and that puts a lot of pressure on me,” Manasi says. “If I need £300 per month for my expenses, I can’t ask my father or mother for that money. How can I ask them just because I want to enjoy myself or go on trips? It feels like a lot of pressure and guilt on my shoulders.”