Michael Sheen highlights the debt crisis for low incomes. One Welsh financial institution explains why it’s time for the Fair Banking Act now.

Michael Sheen, the Welsh actor, spent £100,000 of his own money to purchase £1 million of debt owed by over 900 people in South Wales. In his documentary, Michael Sheen’s Secret One Million Pound Giveaway, the community in Port Talbot, South Wales, was affected severely by the closure of the blast furnace, resulting in thousands of workers losing their jobs. Many families around the community fall into poverty and suffer from heavy debt loads.

In the documentary, Kerry, the manager of the local boxing club gym and community center, who has a full-time job but has been forced to rely on food banks every month and is owed £12,000 in credit card debt. “It’s really hard because it just seems like a never ending battle. I don’t know the interest is multiplying and getting bigger and bigger.” Kerry says.

“It seems wrong that the people who are struggling the most are the ones that end up paying such high rates,” says Karen Davies, the CEO of Purple Shoots, a non-profit microcredit institution, which dedicated to providing accessible and ethical financial support to those rejected by mainstream banks.

According to the Money and Pensions Service, more than eight million people in the UK were in debt in 2023, with a further 12 million living on the edge financially.

“It’s partly to do with a system that the banks just don’t serve the people at the bottom end of the market. Because the banks think they are too high-risk, and they are not interested in small amounts of money,” says Karen.

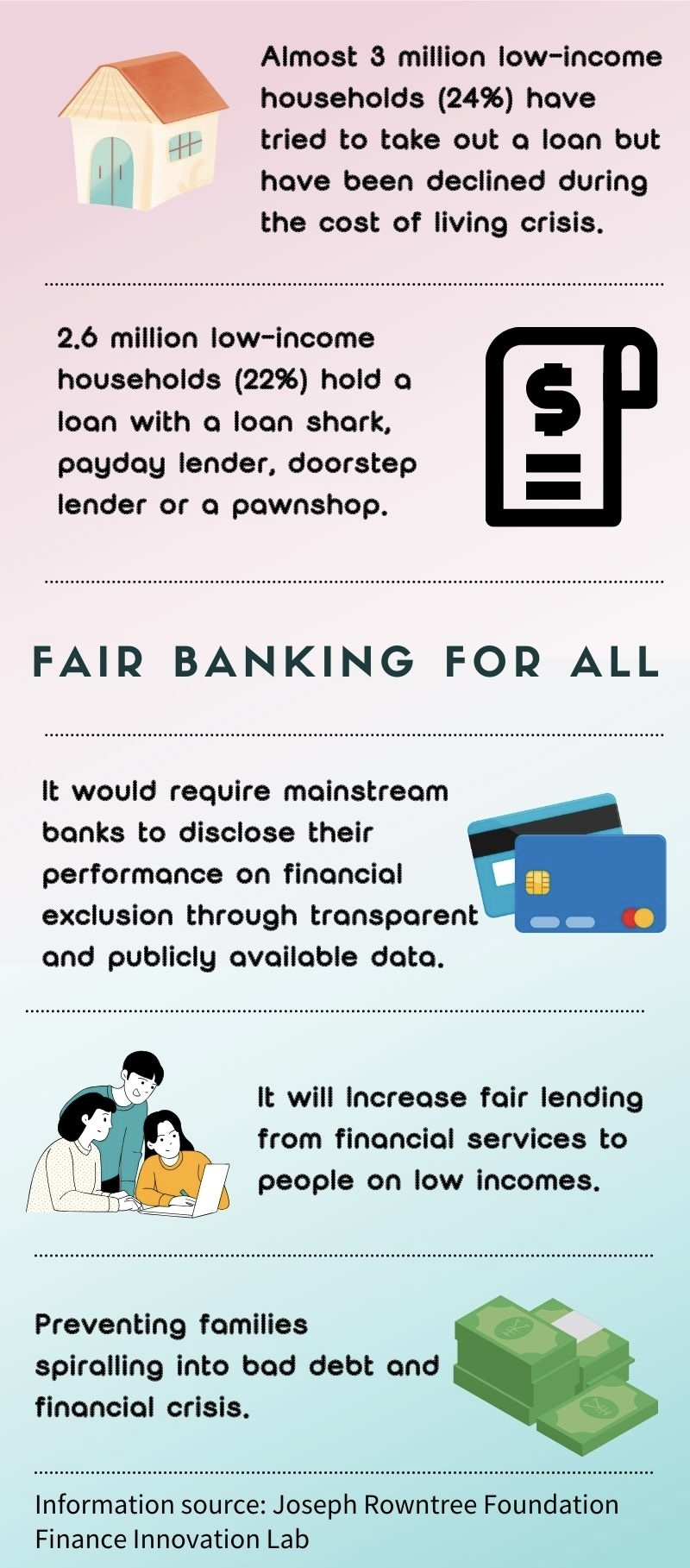

According to a 2024 Joseph Rowntree Foundation (JRF) report, low-income households are struggling to afford their bills. In October 2024, 2.2 million low-income families (19%) held high-cost credit loans from unregulated lenders (loan sharks), doorstop lenders, payday lenders or pawnshops.

As housing, energy, and other bills continue to rise, many families have been coping with the higher cost of living by depleting their savings and relying on credit cards. However, due to low credit scores, more people who might not be approved by traditional lenders are turning to high-cost lenders.

“There are many reasons for a bad credit score. If you are late with the payment to a water board and your council tax, or new immigrants or refugees, then that counts against you,” Karen says, “It’s kind of a downward spiral. It’s not because they can’t manage money, they just don’t have enough money. The only option for them is high-cost providers.”

“People who come to us are trying to find a way out. When we look at their finances, they are really struggling. They are trying to start a business to improve that. Their income from the welfare state is not enough to cover the living costs,” says Karen, “They invariably have got some sort of high-cost credit or a loan from somebody that is very expensive.”

In order to provide a fair financial environment for low-income families, Sheen founded the End High Cost Credit Alliance in 2017. He has campaigned against high-cost credit and is lobbying MPs to consider the Fair Banking Act.

According to Finance Innovation Lab, the Fair Banking Act would require mainstream banking institutions to disclose their performance in financial exclusion within a transparent and open data disclosure framework. Furthermore, it would require providing fair services to those who are underserved and excluded, either directly or via a partnership.

“As we are a charity, we don’t have the budget that big banks have,” Karen says, “We think the Fair Banking Act would be beneficial for us and for people who borrow money.”

Although credit can provide short-term financial support, it often cannot address the long-term root causes of poverty.

In addition to providing small loan funds, Purple Shoots is also running some self-reliant groups, such as craft workshops, woodwork activities, and community cafes.

“We are trying to create a pathway for people into employment or enterprise. We start off the little groups with people who are very far from employment but want to change and try,” Karen says, “It’s a way of helping people who are not confident and who think they can’t earn money. We encourage them to think about what they need to do next.”

“It might not go all the way to employment or a job. Some of the groups just earn a little extra money. But it offers something completely for all the people at the bottom of the market.” Karen says.

“I set up Purple Shoots to fundamentally tackle poverty and unemployment that I saw around being Wales,” Karen says, “To help people who were facing poverty and want borrow money to start a business. But it’s also for people that no one else will help.”

Purple Shoots is also supporting a program called the prison program. In the last year, Purple Shoots has been working in a local prison, helping prisoners interested in self-employment to plan their businesses and then supporting them when they are released to get those businesses off the ground. 12 prisoners so far have been supported in this way.

“We want to cover the whole of the UK or for other organizations like us to start up the same thing so that there is a proper provision for people who are at the bottom end of the marker,” Karen says.