As living costs keep increasing in the UK, how are low-income people paying higher with fixed earnings?

Low-income people are facing difficulties meeting their basic needs amid the increasing cost of living.

The cost of living crisis has led to protests across the UK as organisers said that low-income households and individuals are taking the worst hit.

“It feels very unfair. Quite a bit of very poor people can be really squeezed when they’re already struggling,” said Dr Adam Johannes, the co-convenor of Cardiff People’s Assembly, who is organising the protest in Cardiff.

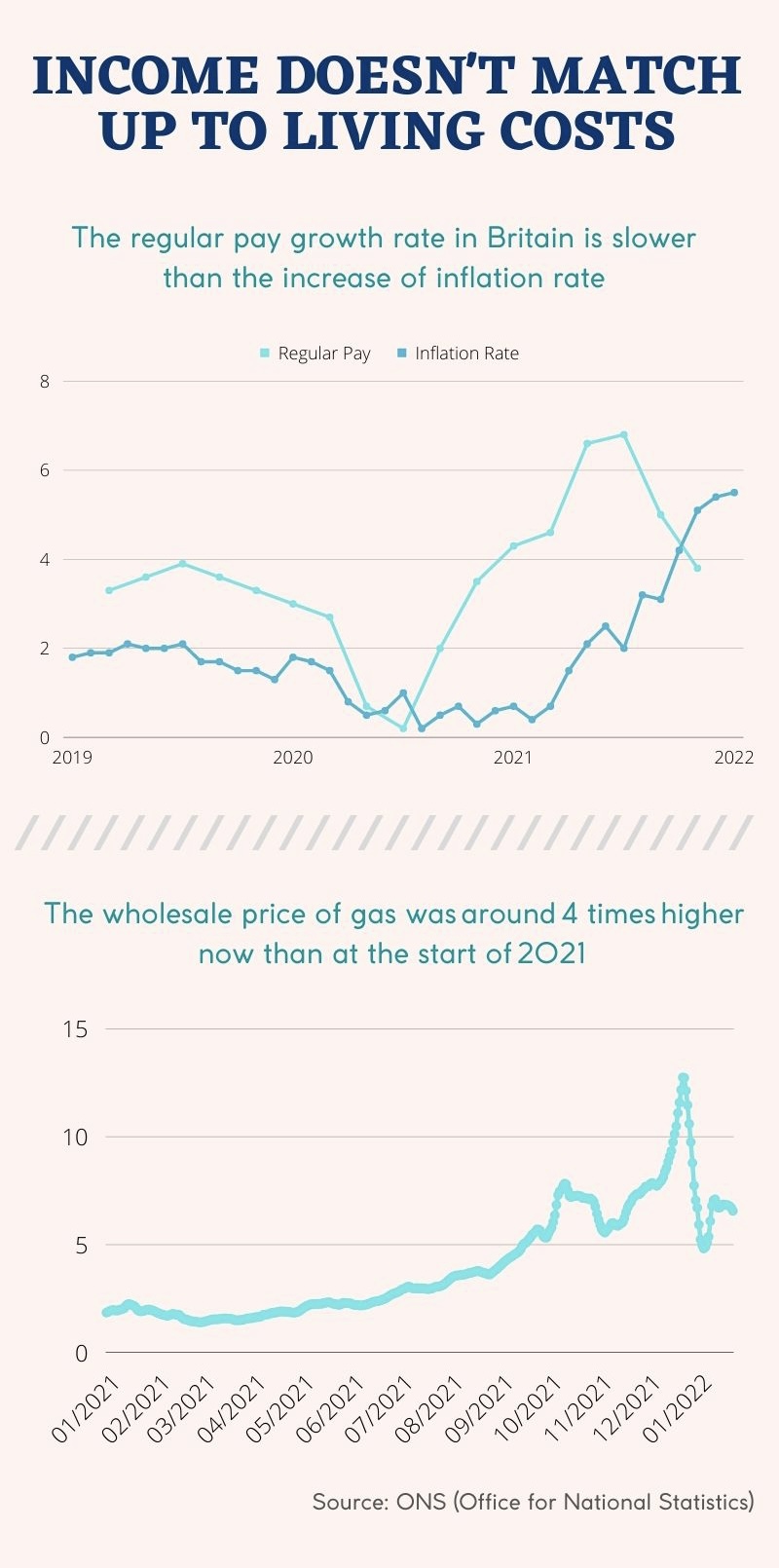

Dr Johannes said that people are spending more on food and energy, while the wages are still the same. According to the ONS (Office for National Statistics), wages increased last year, however, the actual wages are 0.8% less since inflation hits a thirty-year high. The wage level in the UK is unable to keep pace with the living costs, people are forced to cover more with less.

As wage growth lags behind the increase of living costs, low-income people are under greater pressure to live above subsistence level.

According to the ONS, the poorest 10% of households are spending more on essentials such as gas, electricity, food, and transport compared to the richest 10%.

“What we are seeing is that people’s incomes are not matching up to those costs, and that’s putting pressure on families and making people have to make difficult decisions about can they afford all the essentials,” says Dr Steffan Evans. He is the head of poverty policy in Bevan foundation, they suggest the Welsh government creatively and progressively use its devolved powers to top up incomes and reduce costs.

The living cost is still going up, people have no choice but to pay. The economically deprived have to choose between food and heat. “We barely have the heating on the whole winter because I don’t put it on,” said Sarah Spoor, a mother with two disabled sons who need 24-hour medical support.

“Because then I’m worried about whether I can pay for it,” said Spoor. Her only source of livelihood is the government benefits.

To help with the cost of living crisis, the UK government has confirmed to offer a £200 discount on energy bills for homes in Scotland, England, and Wales. However, it is a loan and will be taken back within 5 years.

“You are going to pay £40 back every year for five years. So that’s not a discount that is a loan and a lot of people don’t want that, even if they’re on a low income because we are expecting the prices to still continue going up into the next year, and that just makes people more anxious if they think there’s another bill. I think a lot of people are very stressed, either unemployed and trying to find work or with disabilities, and all these extra costs coming in just makes your life harder,” said Spoor.

The cost-of-living crisis in the UK is worsening, with inflation reaching its highest rate at 5.4% for 30 years. The living costs will continue to increase as much as 50% at the end of April as predicted. The lowest-income families are under greater pressure. “The people at the bottom we’re paying a much higher percentage of our income on food and on heat,” said Spoor.

While people are worried about the increasing living costs which have been caused by the energy price hike, oil giant BP unveiled annual profits of £5.6billion. “This year, it feels like these private companies are making quite big profits but are passing on the hit of the economic problems on to us,” said Dr Johannes.

According to Dr Johannes, other European countries are taking measures to alleviate their citizens’ economic pressure. In Norway, the government charges a windfall tax on energy companies to alleviate fuel poverty, for those who have trouble paying energy bills. But in the UK, there is far more that could be done. “Our government is not prepared to take measures to protect your ordinary citizens from this constant crisis, which we haven’t really caused,” said Dr Johannes.

Dr Johannes said the government needs to increase the minimum wage to get people off the hook. “We’d like to see the government raise the minimum wage. Another problem is we need a minimum wage in this country, which is a real living wage.”

The “Can’t Pay, Won’t Pay” protest will take place in Cardiff on 19th February, outside the government offices on Wood Street.